New Executive Order Impacts Imports from China: Additional Tariffs and the End of De Minimis Exemption

On February 1, 2025, President Trump signed an Executive Order (EO) that imposes an additional 10% ad valorem tariff on most imports from China, which includes products of Hong Kong. U.S. Customs and Border Protection (CBP) quickly followed up with important guidance regarding these changes, particularly impacting the trade community's handling of de minimis shipments from China. Effective February 4, 2025, de minimis shipments from China will no longer be eligible for the administrative exemption from duty under 19 U.S.C. § 1321(a)(2)(C), and will be subject to the new 10% tariffs.

Here's everything you need to know about the changes:

Key Highlights of the Executive Order and New Tariffs

- Additional Tariff:

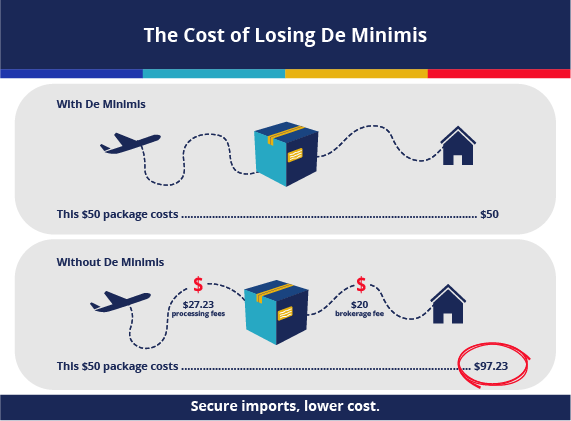

The EO mandates a 10% ad valorem duty on a wide range of products imported from China, including those from Hong Kong, regardless of value. This tariff applies to most goods coming from China, with few exceptions (such as certain products excluded in specific HTSUS classifications). - End of De Minimis Exemption:

Prior to the EO, shipments valued under $800 from China could enter the U.S. free of duties under the de minimis exemption. However, starting February 4, 2025, these shipments will now be subject to the additional 10% tariff. As a result, CBP will reject requests for de minimis entry for these shipments, and importers must file a formal or informal entry and pay the applicable duties and fees. - Impact on Filers:

Importers and filers must pay attention to any shipments that were processed under the de minimis threshold before February 4, 2025, but were not yet arrived. Any such shipments will now be subject to the new tariff, and pre-arrival clearances for these goods will be canceled.

What This Means for the Trade Community

- Changes in ACE (Automated Commercial Environment):

CBP has updated its ACE system to reflect these changes, and these updates went into effect on February 3, 2025. Filers are urged to carefully review the technical changes and test the new tariff codes to ensure compliance. - Formal and Informal Entry:

For any affected shipments, importers will now need to file the correct entry type and pay the associated duties and taxes. If an entry was previously filed under de minimis but the shipment arrives after February 4, 2025, the shipment will no longer be eligible for that exemption. - Foreign Trade Zones:

Importers using foreign trade zones should be aware that any Canadian products admitted to these zones after the new duty rates go into effect will be subject to the additional tariff once cleared for consumption.

Handling Shipments: De Minimis Exemption Gone

Since the EO has eliminated the de minimis exemption for goods from China, all affected shipments must now be cleared with the correct formal or informal entry procedures. If your shipments fall under the new rules and you're unsure how to proceed, you’ll need to work closely with your CBP representative or the ACE Help Desk to avoid costly errors.

Additionally, CBP has clarified that no drawback is available for the new duties, meaning importers cannot reclaim these tariffs after the goods are processed.

Additional Technical Guidance Coming Soon

CBP has promised additional updates through its Cargo Systems Messaging Service (CSMS) as needed. If you are affected by these changes, it’s crucial to stay in close contact with CBP and follow their guidance to ensure compliance.

What’s Next?

- Monitor Shipments:

All stakeholders in the trade community must be vigilant, ensuring that all imports from China and Hong Kong are properly documented and that appropriate duties are paid. - Review Filings:

Ensure that any shipment from China that was processed as de minimis prior to February 4, 2025, is filed correctly once it arrives in the U.S. and that the additional 10% tariff is applied.

By staying informed and prepared, your business can navigate the new rules effectively and avoid costly mistakes. For more detailed guidance, keep an eye on updates from CBP and consult with your trade compliance team or CBP representative.

Stay Compliant and Prepared!

With these new tariff rates and the end of the de minimis exemption, it's crucial for all importers to review their processes and filing procedures. By staying proactive and informed, you can continue to manage your shipments efficiently and avoid any potential compliance issues.

Get actionable advice on cost-saving strategies that boost your bottom line.

Subscribe here: