The Duty Drawback Blog

Our blog articles are written by our team of experts with the knowledge and experience to identify and implement cost-saving strategies for your business. Let us guide you through the Duty Drawback process and ensure that you're taking advantage of all available opportunities. We endeavor to provide actionable advice that can help you optimize your supply chain and boost your bottom line.

The latest on the reciprocal tariffs have them hanging in the balance. On August 29, 2025, the U.S. Court of Appeals for the Federal Circuit, affirmed a lower court decision finding that the reciprocal tariffs exceeded presidential authority under IEEPA. The court stayed its mandate until October 14, 2025, giving the g

On July 27th, the Trump Administration announced a deal with the EU imposing tariffs of 15% on most goods entering the US from Europe. As of August 1st, the 15% blanket tariff will cover most US imports. The US will have a 0% tariff for some items including equipment for US manufacturing and generic medicines.

The American company reached out to ITM for guidance. They were pleased to learn that under U.S. Customs regulations, they could file for duty drawback—a refund of duties paid—on expired and destroyed goods. Within just four months, ITM had successfully obtained the required authorizations and filed all claims related to the product destructions. Due to ITM’s relationship USCBP, and their expertise, over $850,000 in duty refunds was recouped.

On May 28, 2025, a U.S. trade court ruled that President Donald Trump over stepped his authority in imposing the reciprocal tariffs. At that time, the court ordered an immediate block on said tariffs. As of May 29, 2025 a federal appeals court temporarily reinstated the most sweeping of Trump's tariffs. Pausing the lower court’s ruling, The United States Court of Appeals for the Federal Circuit in Washington is going to consider the government's appeal, and has ordered the plaintiffs in the cases to respond by June 5 and the administration by June 9. This is a developing situation and we will do our best to keep the information coming.

This jewelry retailer's duty drawback success story demonstrates the significant impact that a well-managed duty drawback program can have on profitability. By recovering significant funds, the jewelry retailer was able to reinvest in their business, enhance competitiveness, and strengthen their bottom line in a challenging market.

As of 12:01am, March 4, 2025, tariffs of 25% are effective on products from Canada and Mexico and energy products from Canada are subject to a 10% duty. Products that are presently excluded from these tariffs include goods that are for personal use, goods entered under Chapter 98, donations that are imported under HTSUS 9903.01.21and merely information items included under HTSUS 9903.01.22. All other imported items will carry the 25% tariff and no drawback is permitted on these duties.

The upcoming changes to steel and aluminum tariffs will significantly impact the steel and aluminum industries, with numerous provisions to ensure compliance. Importers, exporters, and manufacturers in the steel and aluminum sectors should stay informed about the latest developments and ensure their operations are aligned with these new tariff regulations.

On February 1, 2025, President Trump signed an Executive Order (EO) that imposes an additional 10% ad valorem tariff on most imports from China, which includes products of Hong Kong. U.S. Customs and Border Protection (CBP) quickly followed up with important guidance regarding these changes, particularly impacting the trade community's handling of de minimis shipments from China. Effective February 4, 2025, de minimis shipments from China will no longer be eligible for the administrative exemption from duty under 19 U.S.C. § 1321(a)(2)(C), and will be subject to the new 10% tariffs. Here's everything you need to know about the changes:

On January 20, 2025, President Donald Trump was sworn in for his second term, and with that came big promises regarding trade policy. But a significant shift came just days later, on January 21, when Trump announced plans to impose 25% tariffs on Mexico and Canada—set to go into effect on February 1, 2025.

On January 20, 2025, President Donald Trump was sworn in for his second term, and with that came big promises regarding trade policy. But a significant shift came just days later, on January 21, when Trump announced plans to impose 25% tariffs on Mexico and Canada—set to go into effect on February 1, 2025. This move represents a dramatic change in North American trade relations and could have wide-reaching effects on American consumers. At a signing ceremony in the Oval Office, Trump revealed that his administration would roll out tariffs on goods from two of the U.S.'s largest trading partners, Mexico and Canada. However, this new tariff decision doesn’t fully align with the aggressive trade strategy Trump promised during his campaign. The sweeping tariffs Trump pledged on his first day in office, including a 25% tariff on Mexico and Canada, have yet to materialize. His executive action, while still outlining a broad trade policy overhaul, serves more as a placeholder for a more extensive, long-term plan.

Although the United States and Taiwan (officially known as the Republic of China) do not maintain formal diplomatic relations, the two countries share strong cooperation in several areas, including trade. Trade discussions are managed through the American Institute in Taiwan and the Taipei Economic and Cultural Representative Office in the U.S., under an arrangement called the U.S.-Taiwan Initiative on 21st Century Trade. This framework allows both nations to address trade and investment issues, while working toward mutual priorities over time.

As of January 1, 2025, new tariff rates on certain Chinese imports will go into effect, as part of the ongoing Section 301 investigation into China's trade practices, particularly regarding technology transfer, intellectual property, and innovation. The United States Trade Representative (USTR) has announced additional tariff increases under the Section 301 Four Year Review, which impacts a range of products, including certain tungsten products, solar wafers, and polysilicon. If you're involved in importing these products or handling customs filings, it’s crucial to understand the latest developments and the steps required to comply with the updated regulations.

In his recent article, "Why China Welcomes Trump’s Energy Tariffs", energy and geo-economics expert Wesley Alexander Hill provides an intriguing take on how U.S. tariffs, especially those targeting energy products, might inadvertently benefit China rather than harm it, as intended by former President Donald Trump.

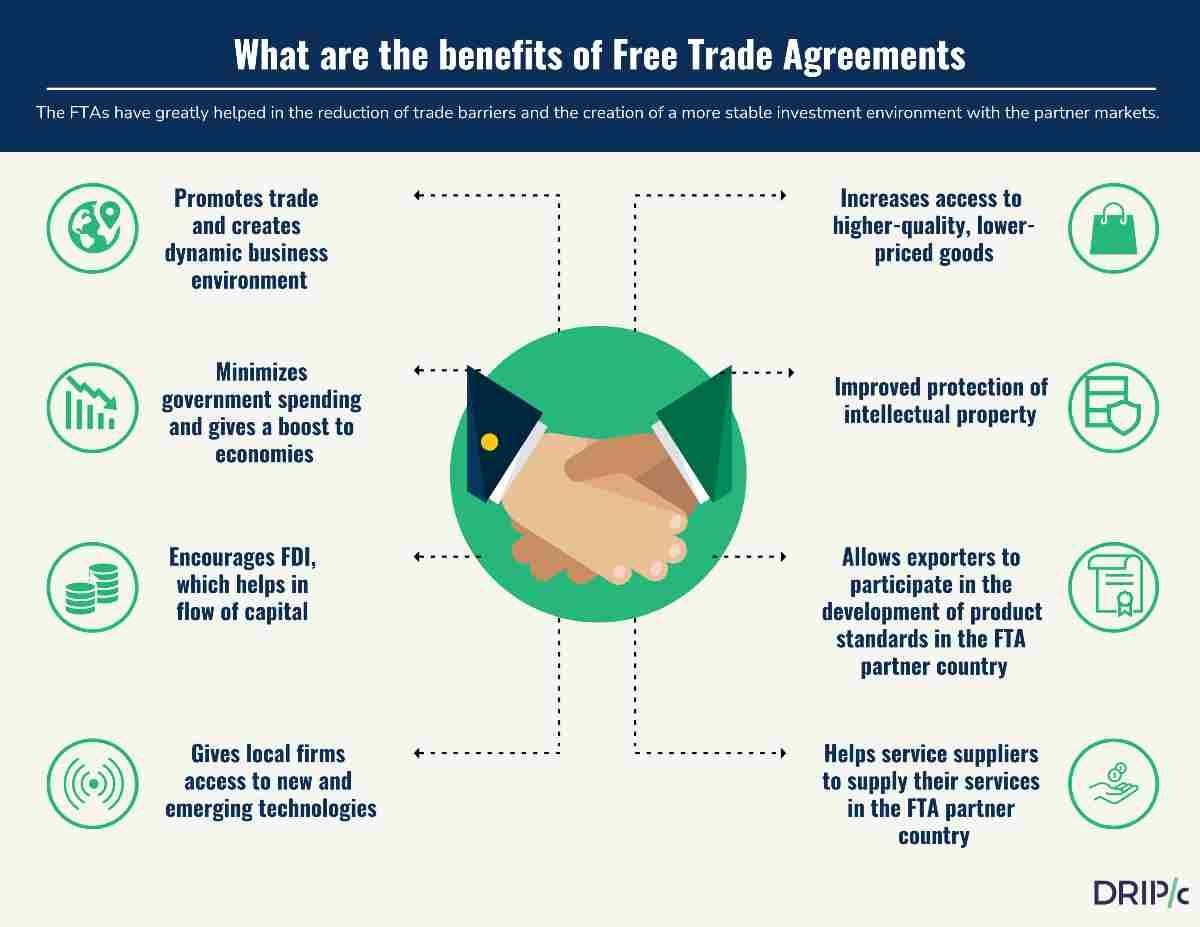

Free Trade Agreements (FTAs) and U.S. Economic Influence: A Snapshot of 20 Countries Free trade agreements (FTAs) are vital tools for the United States, designed to open international markets to American businesses, enhance the competitiveness of U.S. products abroad, and give consumers access to a broader range of goods in the global marketplace. These agreements also grant the U.S. increased political influence, integrating partner countries into the American economy and making them less likely to align with rivals such as China or Russia. Republican presidents have typically championed FTAs, viewing them as beneficial to business and an essential means of exerting American influence internationally. However, FTAs are controversial. Critics argue that they can lead to the relocation of jobs overseas, as businesses seek to produce goods where labor and materials are cheaper. There are also concerns that FTAs can erode local cultures and lead to cultural homogenization, which is often felt more acutely by smaller, less dominant cultures. These concerns have made FTAs less popular within the Democratic Party.

On December 11, 2024 , the U.S. Trade Representative (USTR) announced increases in tariffs on certain tungsten products, wafers, and polysilicon, following its September 19, 2024, solicitation for comments. These tariff increases will take effect for goods entered on or after January 1, 2025 , and are part of the USTR’s final action under the statutory four-year review of existing Section 301 duties on China.

With Donald Trump returning to the presidency, global trade professionals are facing an uncertain and rapidly evolving landscape. Given his past policies and rhetoric, significant shifts in the global trade environment seem likely—shifts that could have far-reaching effects on international markets and economies. In this post, we’ll explore the potential implications of a second Trump presidency on global trade, the key role of trade professionals in adapting to these changes, and crucial areas of focus such as the De Minimis rule, Most-Favored-Nation (MFN) status, export controls, and investment restrictions.

As the possibility of renewed Trump-era tariffs looms, industries are already planning how to protect their supply chains from potential disruptions. President-Elect Donald Trump has proposed imposing blanket tariffs of up to 20% on all imports, and even higher tariffs—ranging from 60% to 100%—on goods from China.

For over three decades, the European Union (EU) and the Gulf Cooperation Council (GCC) have been trying to finalize a free trade agreement (FTA). However, despite early talks, the deal has remained elusive. The main roadblock? The EU's tendency to mix economic issues with political and ideological concerns—an approach that has ultimately hindered progress.

In a significant development for U.S.-Chile trade relations, the two nations have approved a pivotal agreement that bolsters the existing Free Trade Agreement (FTA) between them. This new accord, formalized through an exchange of letters, introduces enhanced protections for U.S. cheese exports to Chile—an essential market for American dairy products.

U.S. Customs and Border Protection (CBP) has recently issued a crucial reminder to businesses regarding the compliance requirements for drawback claims. As many companies navigate the complexities of customs regulations, it’s essential to understand the consequences of failing to meet these requirements.

In the intricate world of international trade, various mechanisms exist to facilitate smoother transactions and encourage commerce across borders. One such mechanism is duty drawback, a process that offers significant benefits to businesses engaged in importing and exporting goods. In this guide, we will delve into the concept of duty drawback, its benefits, and how businesses can leverage it to their advantage.

A free trade agreement (FTA) is an agreement between two or more countries where the countries agree on certain obligations that affect trade in goods. Currently, there are 14 Free Trade Agreements in effect in the U.S. with 20 different countries.

An importer collects and maintains the information to support the FTA qualification. An exporter from the U.S. is required to complete a declaration verifying that their goods qualify for free trade with the participating country.

The rules associate with FTAs are complicated and the analysis is intricate. There are multiple steps to the process and each one must be completed in order to move onto the next.

1. Classify the product according to the HTSUS in order to determine the rule of

origin for the specific finished product

2. Choose a preference criteria from the 4 available.

3. Use the rule of origin to determine the qualification of the finished good.

Duty Drawback is a refund from Customs, for 99% of the duties paid on imported materials that are subsequently exported, destroyed or used in the manufacture of exported goods. Today, only about 25 percent of eligible duty is being recovered. This means that $5 billion dollars goes unclaimed for drawback, and that money might be yours. So, how do you know if you are a candidate for a lucrative duty drawback program?