Preparing for a smooth transition to TFTEA drawback

Navigating through a new, streamlined process

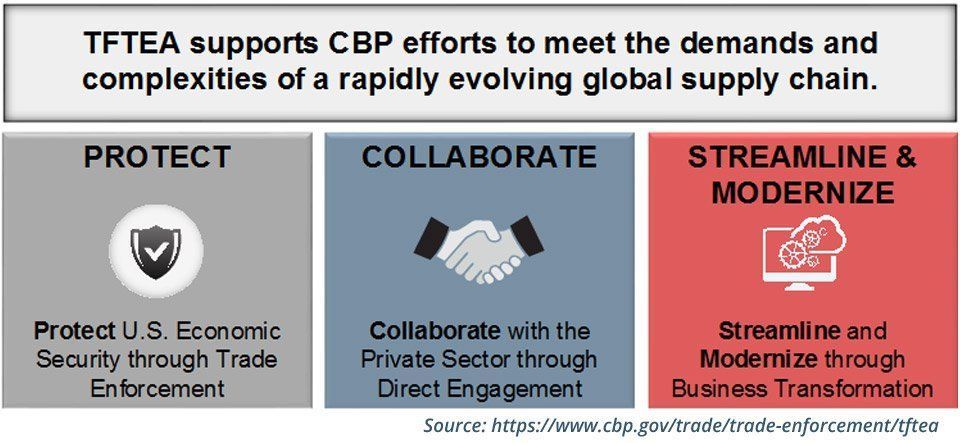

The Trade Facilitation and Trade Enforcement Act of 2015 (TFTEA), went into law on February 24, 2016. The TFTEA amends drawback rules and removes some of the constraints on substitution drawback and overall makes filing easier. Essentially, it eliminates the “commercially interchangeable” standard for substitution and allows for filing drawback for any items classified under the same eight-digit tariff code. After several postponements, deployment is scheduled for February 24, 2018. As we have been waiting for the Secretary of the Treasury and CBP to release the new regulations pertaining to TFTEA, ITM remains very active with the American Association of Exporters and Importers (AAEI) and NCBFFA Drawback Committees that are working with Customs. In fact, we participated in a meeting just this week. While the implementation of TFTEA looms, there is very little information available from Customs about how the Regulations will be altered, the implementation of the changes necessary in the Automated Commercial Environment (ACE) system and how the process will specifically function. ITM has have been following the developments closely, and while nothing is formal, there have been many inferences and suggestions as to what we can expect. Using only the data available in ACE, U.S. Customs will not have access to specific invoice information. With the elimination of this data, they have proposed an implementation of an average price per line item being used as the unit price. This opens up a lot for discussion since an importer can bring many things in under the same HTS with significantly varying unit prices. Using the average will allow you to file with information available on ACE, but may award you substantially less or significantly more drawback to which you are entitled. Further, there is discussion that TFTEA drawback will not allow the use of line items from entries that were used in claims prior to TFTEA. The elimination of certain data from inclusion in claims could not only present an accounting issue for some drawback filers and/or their providers but could also significantly affect drawback returns. It is imperative that companies make preparations for the pending implementation of the changes, even though we remain unsure as to what they will specifically entail. ITM has already started to make accommodations based on the frequent meetings with the Drawback Committees and the limited information that has been provided by Customs. We are prepared to continue filings for our existing clients as well as help new ones navigate the changes without missing a beat. Contact us now if you would like to ensure a smooth transition to TFTEA drawback or are interested in getting a program up and running under the new and more flexible standards.

Get actionable advice on cost-saving strategies that boost your bottom line.

Subscribe here: