Why China Welcomes Trump’s Energy Tariffs: An Analysis by Wesley Alexander Hill

In his recent article, "Why China Welcomes Trump’s Energy Tariffs", energy and geo-economics expert Wesley Alexander Hill provides an intriguing take on how U.S. tariffs, especially those targeting energy products, might inadvertently benefit China rather than harm it, as intended by former President Donald Trump.

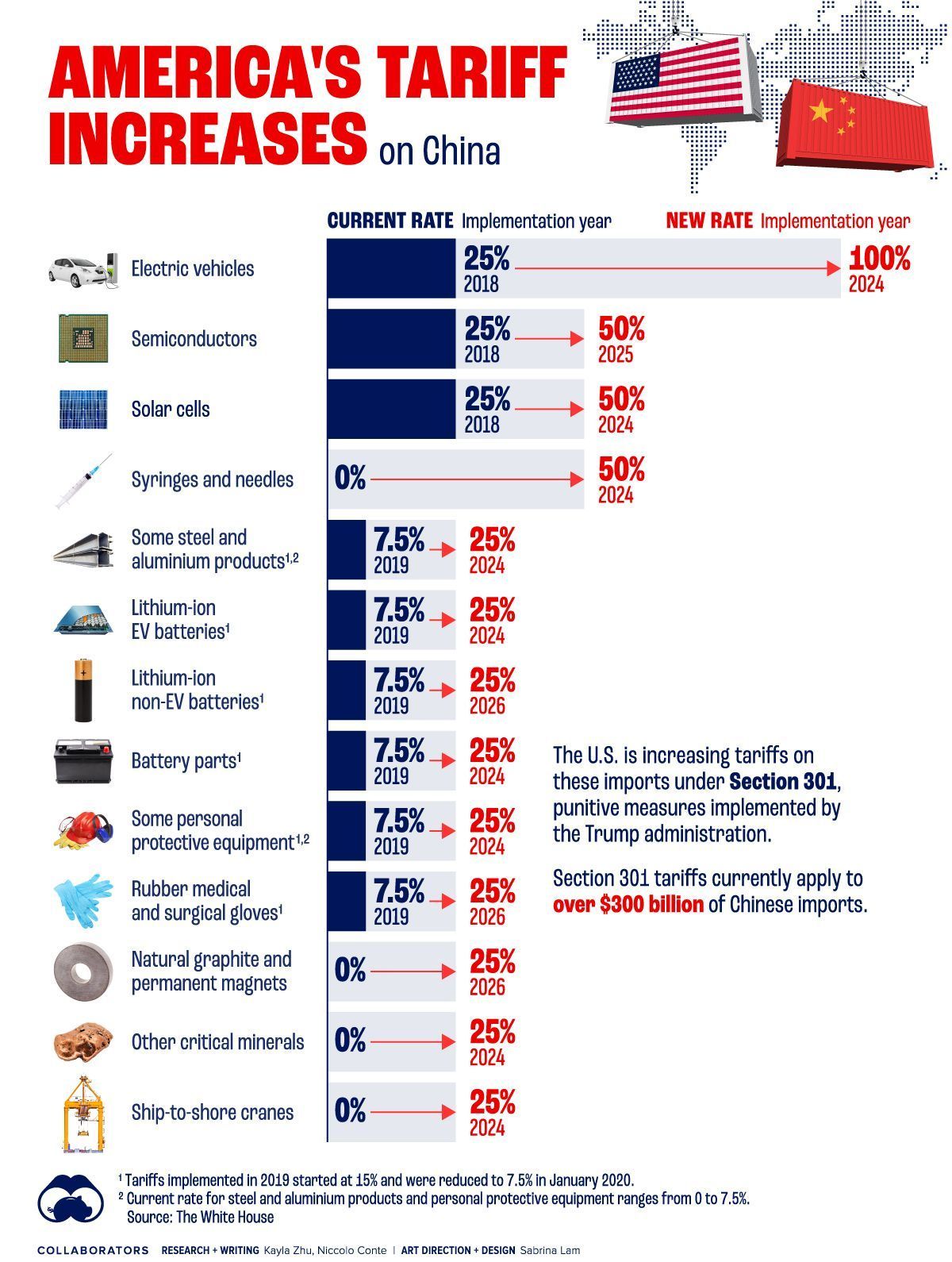

The concept of imposing tariffs to protect domestic industries and reduce reliance on foreign imports has long been central to Trump’s economic policies. During his 2024 presidential campaign, he doubled down on his protectionist stance, promising to impose steep tariffs on foreign energy products, including those from China. The expectation, of course, was that these tariffs would strengthen American industries by making foreign goods more expensive and less competitive. However, Hill argues that China's reaction to these tariffs may not align with typical expectations of an adversary.

Instead of protesting or retaliating in a manner that could hurt its own economy, China’s response has been surprisingly positive. Chinese industry players, ranging from oil producers to manufacturers of solar panels and electric vehicles (EVs), view these tariffs as an opportunity. They argue that by isolating the U.S. from its allies and driving up production costs for American companies, these tariffs could allow China to dominate certain markets and strengthen its position in the global economy.

Hill goes on to explain that China’s economy, despite its outward liberalization, still relies heavily on state intervention, particularly in sectors like energy. This results in inefficiencies that hinder domestic consumption and create economic instability. However, with the U.S. applying tariffs to energy imports, China may be pushed to confront these inefficiencies more urgently. The tariffs could serve as a catalyst for necessary economic reforms, driving China to shift away from low-cost manufacturing and toward a more advanced, consumer-driven economy. This transition has been a central goal of Xi Jinping’s administration, which seeks to elevate China from its middle-income status and break free from over-reliance on cheap exports.

At the same time, Hill highlights that China’s export-oriented economy is at a crossroads. While tariffs might disrupt some of its existing trade relationships, they also create a unique opportunity for China to further its strategic shift towards high-tech industries, particularly in green energy. As the world’s leader in solar panel production, electric vehicles, and critical minerals used for green energy, China is well-positioned to weather the storm caused by these tariffs. In fact, the tariffs may unintentionally speed up China’s transition to a high-tech, sustainable economy.

The article also delves into the broader geopolitical implications. The tariffs could limit global capital mobility, reducing the flow of foreign investments and compelling China to rely more on domestic demand. This, in turn, could reduce China’s exposure to global market fluctuations and align with Xi Jinping’s long-term goals of boosting domestic consumption.

While Hill acknowledges that the immediate effects of these tariffs could create challenges for both the U.S. and China, particularly in terms of retaliatory measures and shifting trade patterns, he ultimately argues that the U.S. tariffs may be accelerating China’s economic evolution in ways that align with Xi’s vision.

Ultimately, Hill suggests that the U.S. may inadvertently be helping China realize its economic ambitions. Rather than punishing China’s economy, these tariffs could be nudging it towards the kind of reforms and transitions it would have pursued anyway, albeit more slowly and with greater internal resistance.

Wesley Alexander Hill’s article is a thought-provoking analysis of how global economic policies and protectionist measures can have unintended consequences. As the U.S. and China continue to navigate complex trade relations, Hill’s insights offer a deeper understanding of the intricate dynamics at play in the global energy and manufacturing sectors.

You can read the full article on Forbes here.

Get actionable advice on cost-saving strategies that boost your bottom line.

Subscribe here: