Navigating Global Trade Under a Second Trump Presidency: Key Challenges and Strategic Opportunities for Trade Professionals

With Donald Trump returning to the presidency, global trade professionals are facing an uncertain and rapidly evolving landscape. Given his past policies and rhetoric, significant shifts in the global trade environment seem likely—shifts that could have far-reaching effects on international markets and economies. In this post, we’ll explore the potential implications of a second Trump presidency on global trade, the key role of trade professionals in adapting to these changes, and crucial areas of focus such as the De Minimis rule, Most-Favored-Nation (MFN) status, export controls, and investment restrictions.

U.S. Economic Policies and Their Impact on Global Trade

Trump’s economic policies have been characterized by tax cuts, increased government spending, and a focus on reducing trade deficits. While these policies are designed to stimulate domestic growth, they may also have implications for global trade dynamics, especially if they lead to higher U.S. debt, rising inflation, or more aggressive interest rate hikes by the Federal Reserve. Trade professionals will need to monitor these fiscal and monetary developments closely as they could influence U.S. trade patterns, alter demand for imports and exports, and impact global supply chains.

The U.S.-China Trade Relationship: Tensions Resurface?

One of the most significant flashpoints for global trade during Trump’s first term was the strained relationship with China. Under Trump, the U.S. imposed tariffs on Chinese goods, escalating trade tensions. If Trump adopts a similar approach in his second term, it could lead to renewed tariffs and trade restrictions. This would not only affect U.S.-China trade relations but could also impact China’s Most-Favored-Nation (MFN) status, influencing global trade dynamics.

Most-Favored-Nation (MFN) Status

MFN status is a cornerstone of international trade, requiring countries to treat each other equally in terms of tariffs and trade barriers. If the U.S. takes a protectionist stance with China, there could be a challenge to China’s MFN status, which would have broad implications for global trade, triggering tariff escalations and creating new barriers for exporters. Trade professionals will need to stay abreast of these developments to adjust strategies accordingly.

Export Controls and Investment Restrictions: A Continued Focus on National Security

The Trump administration placed increasing emphasis on national security concerns in global trade, particularly when it came to technology and sensitive industries. Export controls on products like semiconductors, telecommunications equipment, and advanced technologies, as well as restrictions on foreign investments, particularly from China, are likely to continue. These measures could disrupt global supply chains, especially in tech-driven sectors.

Navigating Export Controls and Investment Restrictions

Trade professionals will need to adapt to these growing export controls and investment restrictions. Understanding compliance requirements is essential to avoid penalties and minimize supply chain disruptions. As investment restrictions grow, especially those limiting Chinese investments in U.S. companies, professionals must also consider alternative markets and suppliers to maintain business continuity.

Decoupling vs. De-Risking

One of the key debates for businesses in this environment is whether to fully decouple from China or take a more measured “de-risking” approach. While decoupling involves reducing reliance on China entirely, de-risking seeks to minimize risks without severing ties completely. The choice between these strategies will depend on factors like market exposure, supply chain dependencies, and geopolitical risks. Trade professionals must carefully assess these strategies to build resilient, diversified supply chains that can weather potential shocks.

The De Minimis Rule: E-Commerce and Low-Value Shipments

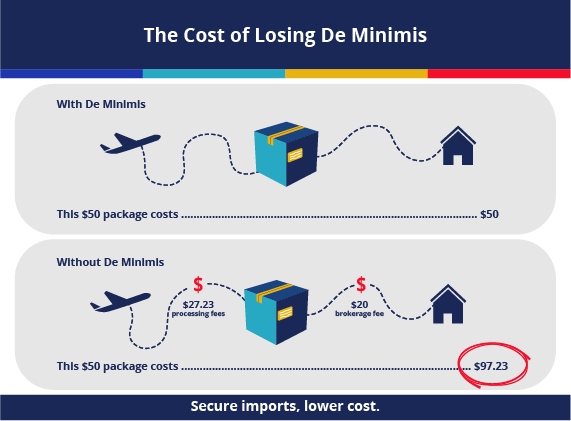

The De Minimis rule allows low-value shipments to enter a country without incurring customs duties or taxes, which is especially important for cross-border e-commerce. Changes to the De Minimis threshold in the U.S. could have a significant impact on international trade, particularly in the e-commerce sector. A reduction in the De Minimis threshold could lead to higher tariffs on low-value goods, increasing costs and complicating cross-border trade.

Adapting to Changes in the De Minimis Threshold

For global trade professionals, staying informed about any potential changes to the De Minimis threshold will be critical. These changes could affect the cost structures of businesses that rely on cross-border e-commerce, requiring companies to adapt their supply chain strategies and compliance processes to avoid costly disruptions.

Implications for Emerging Markets and Central Banks

Emerging markets that rely on dollar-denominated debt or trade with the U.S. could face increased risks if U.S. interest rates rise or if trade tensions lead to a reduction in U.S. imports. This could raise borrowing costs for these markets and negatively affect their economies.

Managing Currency and Financial Risks

Trade professionals working with emerging markets must develop strategies to manage financial risks, including currency fluctuations and rising borrowing costs. Additionally, central banks around the world may adjust their policies in response to changes in U.S. trade policy, further impacting exchange rates and trade relationships. Staying informed about these global financial shifts will be essential for navigating these risks.

Strategic Priorities for Global Trade Professionals

In this evolving global trade environment, professionals will need to stay proactive, adaptable, and well-prepared for the uncertainties ahead. Here are some key strategies that trade professionals should focus on:

1. Scenario Planning and Risk Management

Given the uncertainty surrounding U.S. trade policy, scenario planning will be vital for identifying risks and opportunities. By analyzing different potential outcomes, businesses can create contingency plans and ensure they are prepared for disruptions or changes in the global trade environment.

2. Diversification of Markets and Supply Chains

With the likelihood of increased tariffs and trade barriers, diversification is critical. Trade professionals should seek to diversify supply chains and markets to reduce dependency on any single region, especially China. This diversification will help businesses remain resilient amid geopolitical risks and policy shifts.

3. Compliance and Regulatory Expertise

As global trade policies evolve, staying compliant with changing regulations will be essential. Trade professionals must remain up-to-date on trade agreements, tariffs, export controls, and other regulations to avoid penalties and ensure smooth operations. Developing deep expertise in trade compliance will be crucial in the years ahead.

4. Collaboration and Networking

Building strong relationships with international partners, stakeholders, and industry peers will be essential for gathering insights, sharing best practices, and collaborating on strategies to navigate the complexities of global trade. A well-connected network can help businesses adapt quickly to changing circumstances.

Preparing for the Future of Global Trade

As Donald Trump returns to the White House, the future of U.S. trade policy and global supply chains remains uncertain. The global trade landscape may be marked by rising tariffs, export controls, and investment restrictions, all of which will present challenges—and opportunities—for trade professionals.

To succeed in this changing environment, companies must prioritize scenario planning, diversify supply chains and markets, and stay on top of compliance requirements. Leveraging global trade management technology can help automate processes, ensure compliance, and improve efficiency. By adopting these strategies, global trade professionals can navigate the complexities of a new Trump presidency with confidence, adapting to whatever changes lie ahead.

By staying informed, flexible, and proactive, global trade professionals can not only survive but thrive as the global trade landscape evolves under a second Trump administration.

Get actionable advice on cost-saving strategies that boost your bottom line.

Subscribe here: